Truck Financing Options

Finance Your Truck

Our finance department is here to assist you with your financing, providing a number of solutions that will get you into the truck you need. We offer several solutions:

Retail Finance Loan

This traditional debt financing loan allows you to consolidate the costs associated with putting your truck in service including title, registration fees and tax.

TRAC Lease

This allows you to estimate the residual value upfront and make lower payments than traditional financing.

Fair Market Value Lease

The FMV lease provides you with lower monthly payments than a loan. It includes end-of-term options to either purchase the vehicle at the present fair market value, renew the contract at the present fair market rental value for a mutually agreed upon term, or return the vehicle within the stated terms and conditions.

Skip Payments

This is a great option for a seasonal business because it allows you to take up to 3 months off to coincide with your revenue stream. You can securely apply online by selecting the application links below.

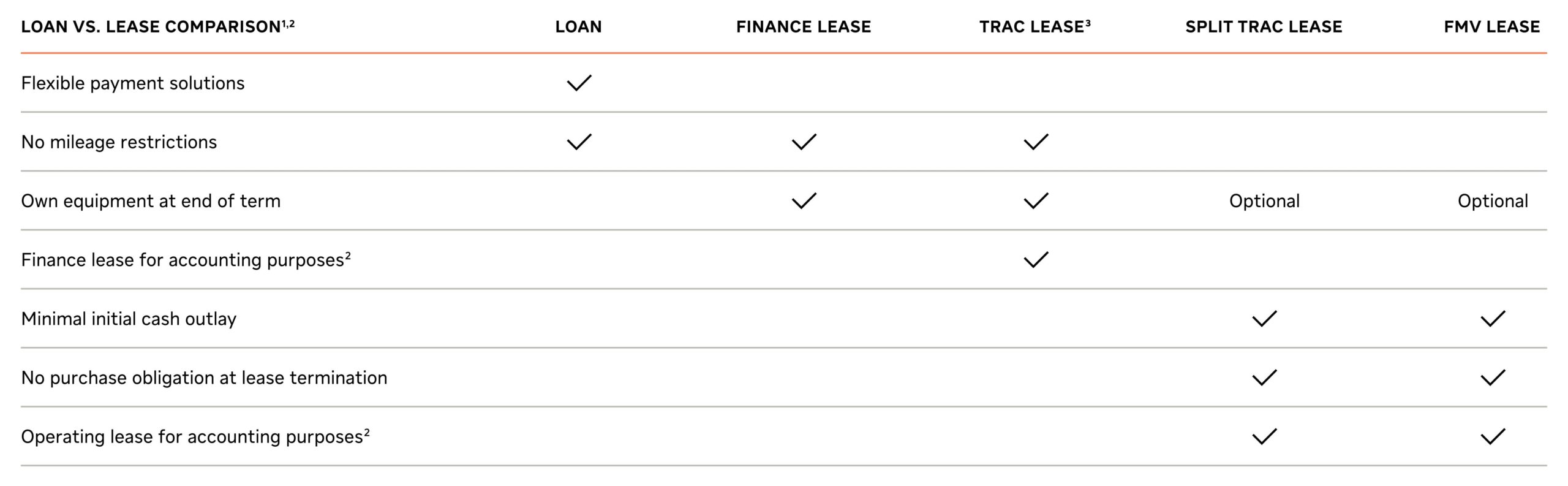

Loan Vs Lease Comparison

- Program eligibility, actual payments, terms and down payment are determined by Navistar Financial Corporation credit team based upon creditworthiness of customer.

- Navistar Financial Corporation does not provide or endorse any tax or accounting advice or tax strategy to its dealers, customers or potential customers. You should consult with your own tax and accounting advisor on all such matters relating to the loan or lease financings described in this brochure.

- TRAC leases are limited to motor vehicles leased to businesses and must be used for commercial purposes at least 50% of the time.

* Lessor & Lessee take pro-rata portion of the estimated residual value risk.

Get Preapproved Today!

1.

Use the Credit Application button below to fill out an online form on our secure platform.

2.

To protect your information, submit the form directly through Adobe Sign or print and bring it into one of our convenient locations.

3.

Our financial team and partners will review your application.

4.

We’ll contact you with next steps!

Follow the link below to complete a secure form.